Von der Heyden Group’s holding company TIMAN Investments Holdings Limited, today published the consolidated results for 2021 and reported an improvement in its adjusted EBITDA margin, the generation of positive cash flow from operating activities, increased investment levels while maintaining a strong liquidity position.

The Group holds for capital growth and income generation investments in 37 subsidiaries and associated companies across eight countries in Europe. The Group’s diverse portfolio is spread across four lines of business; its real estate developments, investments and services; hotel accommodation and catering; asset management; and private equity, venture capital and capital markets investments.

2021 END OF YEAR FINANCIAL STATEMENTS

These achievements have been recorded despite the longer-term effects of COVID-19 on the global economy, namely the ongoing travel and quarantine restrictions on the tourism sector as well as the disruption in logistics and increase in costs on the real estate industry.

Notwithstanding, the Group managed to improve its adjusted EBITDA margin to 37.2% (2020: 32.1%) of EUR 4,284,456 (2020: EUR 7,540,798) despite the decrease in overall revenue for the year to EUR 11,518,975 (2020: EUR 23,505,636) due to the cyclical nature of the real estate industry. Moreover, the Group recorded an increase in positive Cash flow from operating activities in the year by EUR 3,201,030 to EUR 868,274 positive (2020: EUR 2,332,756 negative).

The Group managed a significant positive turnaround of EUR 3,670,749 in its total comprehensive income from a loss of EUR 3,830,459 in 2020 to despite the loss, a near break-even position of EUR 159,710 in 2021. A significant achievement considering the challenging economic climate the Group was operating in.

The Group continued with its deployment strategy into new investments, while maintained sufficient liquidity to meet short-term liabilities including the liabilities for leases under IFRS 16. Applying the cash ratio as a measurement of the Group’s liquidity, (total cash and cash equivalents, including marketable securities to its current liabilities) the Group has a cash ratio of 1.26x. This demonstrates that the Group has the ability to meet the liquidity requirements of its short-term liabilities.

REAL ESTATE DEVELOPMENTS, INVESTMENTS AND SERVICES

The Von der Heyden Group’s proven track record continues to be a pillar of legacy with a reputation of delivering landmark developments in prominent cities such as Munich and Poznań.

Von der Heyden Group’s Real estate development arm remains the principal activity of our Group, fueling our growth ambitions and supporting the Group’s diversification strategy. Over our 33-year history, the Von der Heyden development brand has been successful in delivering sizeable high-quality projects across Europe that not only provide substantial financial returns but also contribute to the well-being of the communities in which we operate, which is and remains a core value of our Group. – Group’s Chairman & Founder Sven von der Heyden

Von der Heyden Group’s Real estate development arm remains the principal activity of our Group, fueling our growth ambitions and supporting the Group’s diversification strategy. Over our 33-year history, the Von der Heyden development brand has been successful in delivering sizeable high-quality projects across Europe that not only provide substantial financial returns but also contribute to the well-being of the communities in which we operate, which is and remains a core value of our Group. – Group’s Chairman & Founder Sven von der Heyden

The Andersia Silver project is the current flagship commercial A Class Building investment of the Group to be completed over the next three years. Subsequent to the excavation and underground completion during 2021, the projected EUR 110 million investment is due to commence its above-ground civil works phase imminently after the successful financing from a consortium of three reputable banks in Poland in March of this year. Andersia Silver will complete the what Poznań, Poland’s cityscape is today: a community-oriented bustling A-Class financial centre that offers a unique opportunity for businesses to claim a spot in one of the major thoroughfares of the city. This new tower will be the highest building in town, a 40,000 sqm of prominent office and commercial space spread over 25 above-ground floors. The fourth phase of this project will conclude a highly regarded 25-year public-private partnership with the City of Poznań.

The Group’s trusted reputation in generating significant returns in new and emerging communities has enabled the Group to enter three new markets including Algarve, Portugal, Reževići, Montenegro and an investment in the renovation of two luxury Villas in Tuscany, Italy with another one planned in Menorca, Spain.

HOTEL ACCOMMODATION AND CATERING

As the Groups’ hospitality subsidiary continues to focus into more profitable and upmarket divisions, the revenue increased by 11% over 2021 to EUR 7,269,136 (2020: EUR 6,525,526), also surpassing by 8% the forecasts for the year of EUR 6,729,607. Given the arduous economic conditions caused by the continuing global pandemic, such a result is highly positive on this segment.

Correspondingly, the Catering segment also saw significant improvements, with an increase of 25% in sales to EUR 2,234,564 (2020: 1,788,830). This success is synonymous with the growth of Hammett’s Collection as the Group continues to expand its partnership in its fourth restaurant brand in Malta.

ASSET MANAGEMENT

Another significant development in 2021 for the Group is the licensing of a special purpose vehicle by the Bank of Italy to acquire asset backed credits on the Italian market. This vehicle allows the Group to issue interest or dividend earning investment instruments that can be sold to investors to fund the acquisition of these credits or finance such acquisition through specialised banks.

The Group already acquired a block of credits, where the strategy is to expand this business through the acquisition of 2 to 3 block of credits a year and to continue to build a structure and network that enables the Group to identify interesting investment opportunities.

The Group suspended the Ukraine Asset Management Company operations in Ukraine following the Russian invasion. The Group had not committed to any real estate transactions in Ukraine and will only pursue this venture once Ukrainian sovereign integrity and stability is restored. The Group is on the other hand taking several humanitarian initiatives to support vulnerable expecting mothers through their safe reallocation to Poland, as well as contributing medical supplies to Kyiv’s largest children hospital.

In over thirty years in the varied markets and sectors in which we operate and continue to operate, our geographical diversity has demonstrated the power of flexibility to adapt and change strategy in an ever-changing climate. Whilst we aim to use this strength to achieve high stabilized financial returns, our vision continues to align with our own and our shareholders’ corporate, social, and environmental sustainability expectations. – Group’s CEO Bob Rottinghuis

In over thirty years in the varied markets and sectors in which we operate and continue to operate, our geographical diversity has demonstrated the power of flexibility to adapt and change strategy in an ever-changing climate. Whilst we aim to use this strength to achieve high stabilized financial returns, our vision continues to align with our own and our shareholders’ corporate, social, and environmental sustainability expectations. – Group’s CEO Bob Rottinghuis

PRIVATE EQUITY, VENTURE CAPITAL AND CAPITAL MARKETS INVESTMENTS

The strong liquidity position maintained will allow the Group to continue financing its investments and enable it to seize new opportunities that may arise in the future to expand its existing portfolio of private equity and venture capital investments as well as selective capital markets instruments to generate stable returns on its excess working capital.

The Group looks forward for 2022 with reinvigorated optimism despite the ongoing challenges brought about by inflationary pressures, the war in Ukraine, the remaining effects of the COVID-19 pandemic and other external pressures. The Board of Directors would like to express their gratitude to the Group’s employees and business partners for their continuing support and contribution to its success.

TIH FS 2021 PRESS RELEASE

Von der Heyden Group’s Real estate development arm remains the principal activity of our Group, fueling our growth ambitions and supporting the Group’s diversification strategy. Over our 33-year history, the Von der Heyden development brand has been successful in delivering sizeable high-quality projects across Europe that not only provide substantial financial returns but also contribute to the well-being of the communities in which we operate, which is and remains a core value of our Group. – Group’s Chairman & Founder Sven von der Heyden

Von der Heyden Group’s Real estate development arm remains the principal activity of our Group, fueling our growth ambitions and supporting the Group’s diversification strategy. Over our 33-year history, the Von der Heyden development brand has been successful in delivering sizeable high-quality projects across Europe that not only provide substantial financial returns but also contribute to the well-being of the communities in which we operate, which is and remains a core value of our Group. – Group’s Chairman & Founder Sven von der Heyden  In over thirty years in the varied markets and sectors in which we operate and continue to operate, our geographical diversity has demonstrated the power of flexibility to adapt and change strategy in an ever-changing climate. Whilst we aim to use this strength to achieve high stabilized financial returns, our vision continues to align with our own and our shareholders’ corporate, social, and environmental sustainability expectations. – Group’s CEO Bob Rottinghuis

In over thirty years in the varied markets and sectors in which we operate and continue to operate, our geographical diversity has demonstrated the power of flexibility to adapt and change strategy in an ever-changing climate. Whilst we aim to use this strength to achieve high stabilized financial returns, our vision continues to align with our own and our shareholders’ corporate, social, and environmental sustainability expectations. – Group’s CEO Bob Rottinghuis

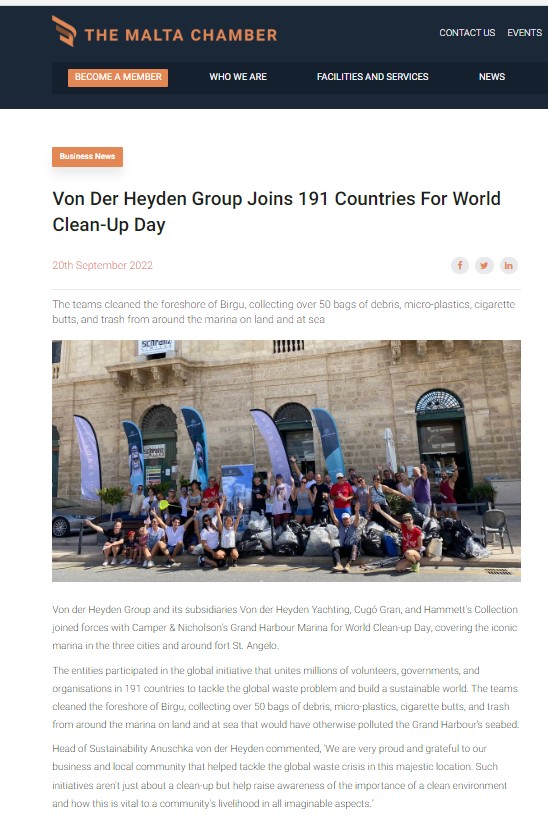

Anuschka von der Heyden said, “For quite some time, I have been seeking a role directly involving me in positive change. My aim is to create and execute strategies that will help the Group become more sustainable on both environmental and social levels. Our future depends on fragile ecosystems, and it is for us to own up to the impacts of our actions. This is particularly relevant to our expanding operations in the tourism and experiential industries. Our vision is to preserve and create value for today’s generations and tomorrow’s.”

Anuschka von der Heyden said, “For quite some time, I have been seeking a role directly involving me in positive change. My aim is to create and execute strategies that will help the Group become more sustainable on both environmental and social levels. Our future depends on fragile ecosystems, and it is for us to own up to the impacts of our actions. This is particularly relevant to our expanding operations in the tourism and experiential industries. Our vision is to preserve and create value for today’s generations and tomorrow’s.”